John Wong

Research Analyst at the Urban-Brookings Tax Policy Center

Research Analyst at the Urban-Brookings Tax Policy Center

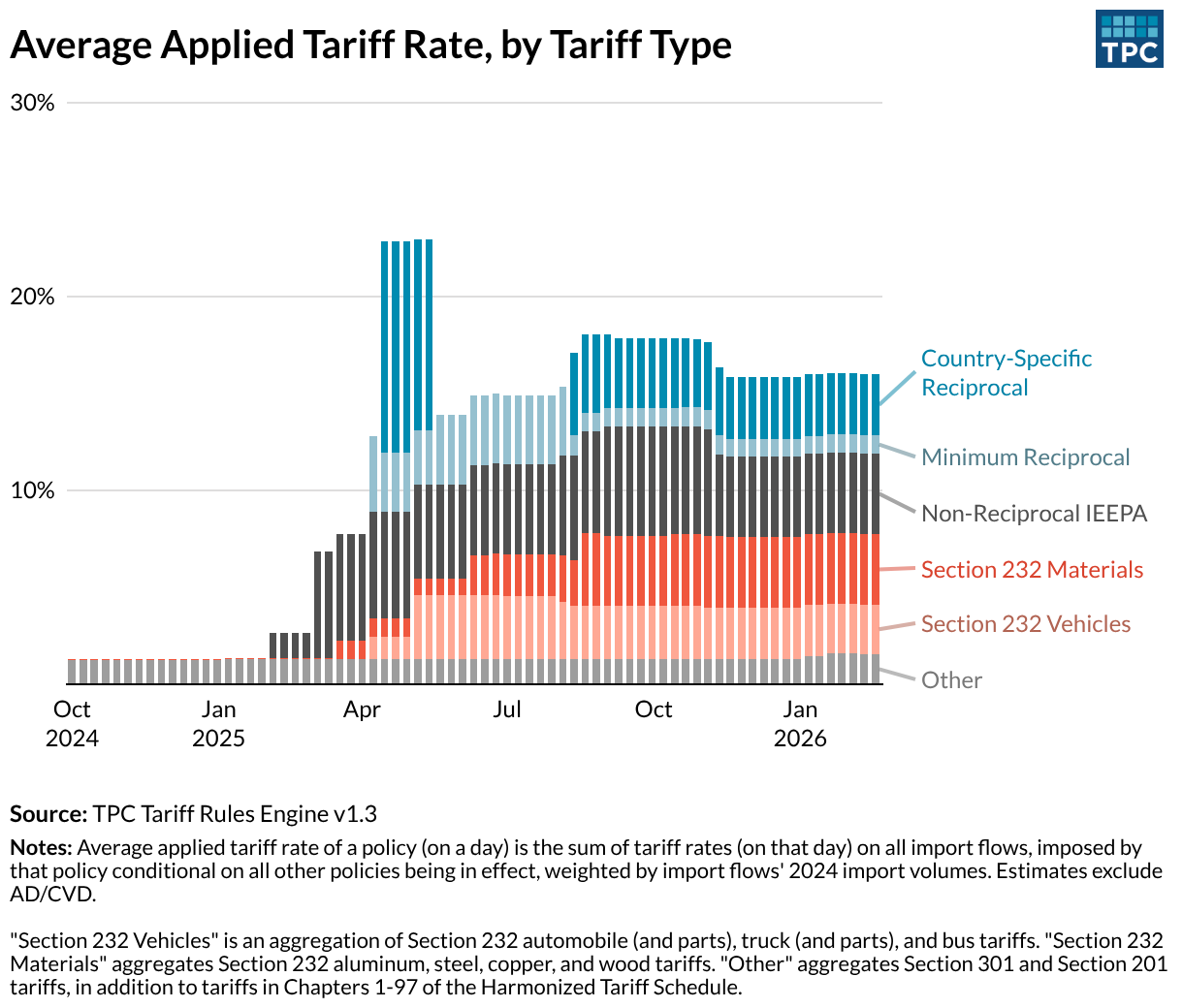

To analyze rapidly-changing and complex tariff policies, I built a program that estimates a tariff rate for each product from each origin, for each policy, each day—resulting in 10 billion tariff rates per simulation. This is supported by a YAML-based rule-encoding system that requires no code for adding new policies.

More

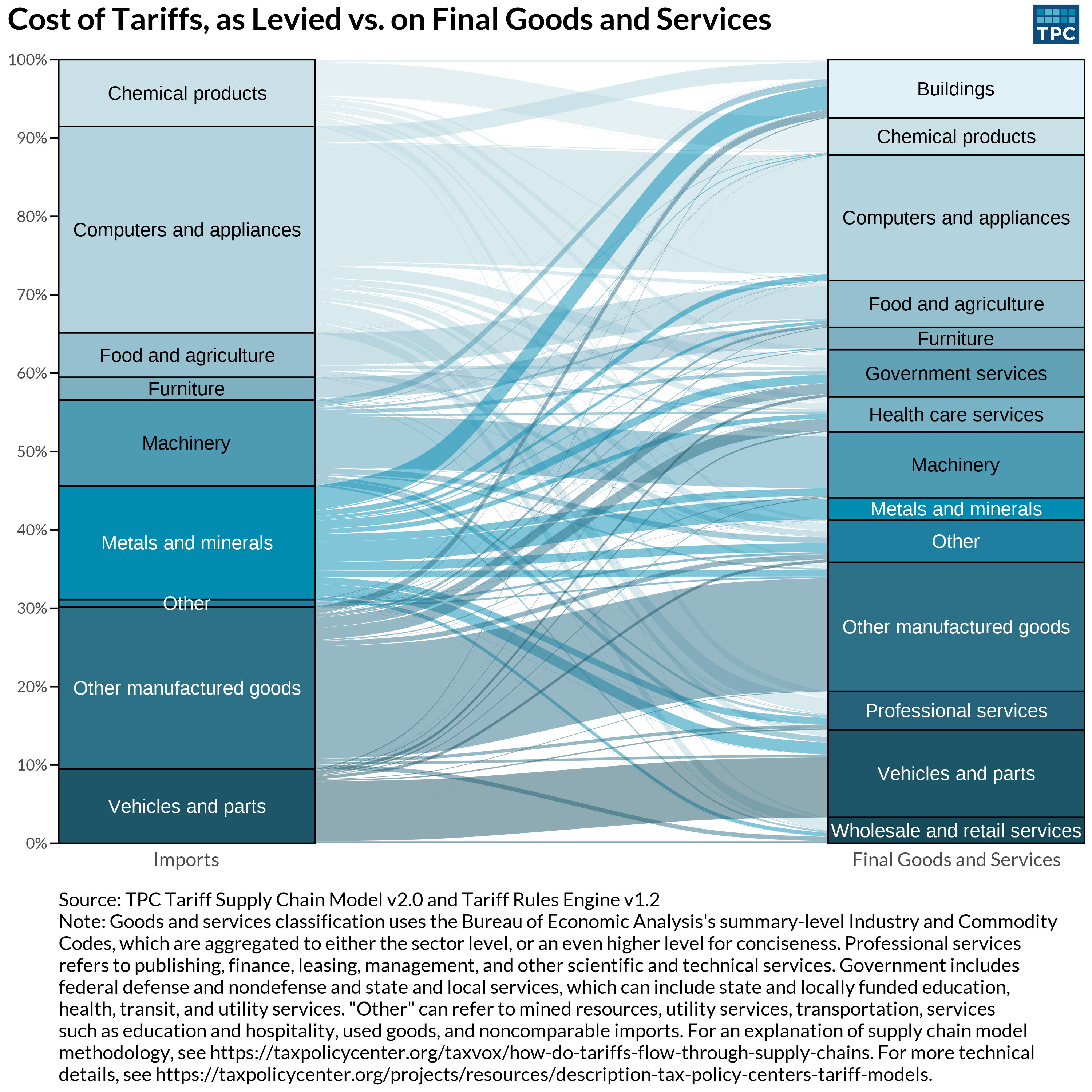

Tariffs on final goods are determined by tariffs on their intermediate inputs. We use input-output tables to map how goods feed into one another, and estimate final burden and price changes.

More

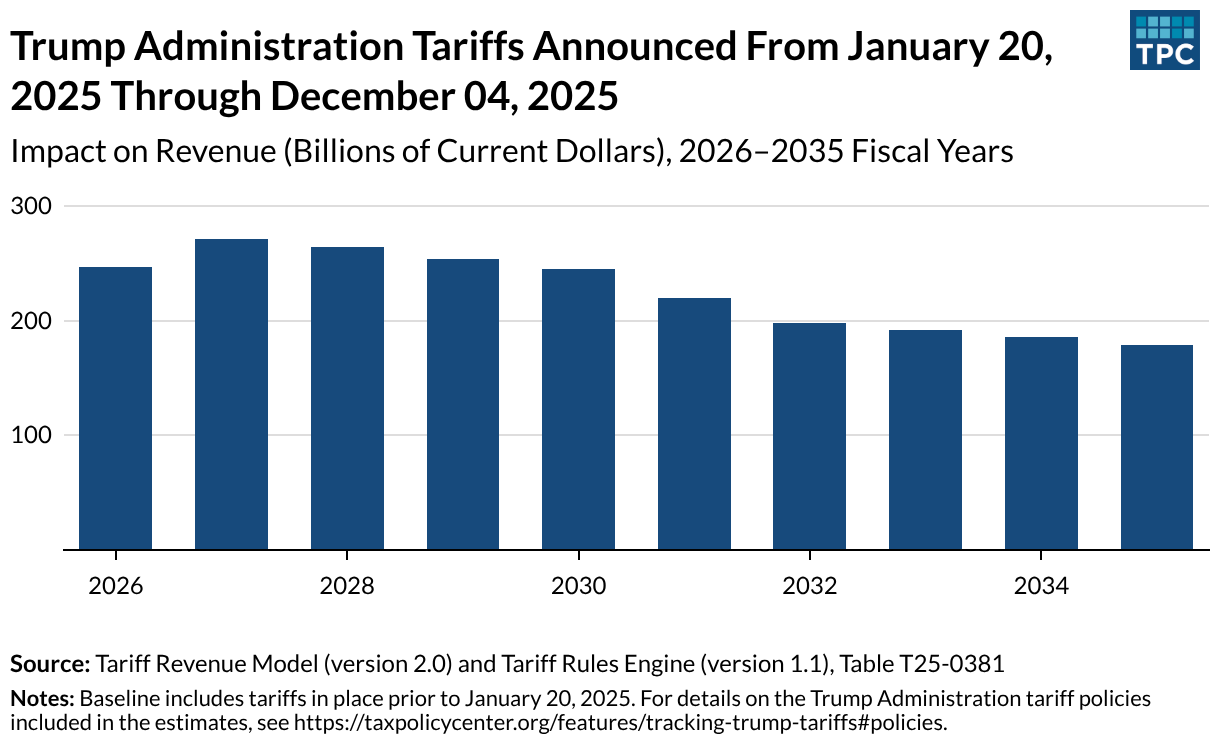

We built a R model that can generally accommodate rapidly changing tariff policy and produce revenue estimates.

More

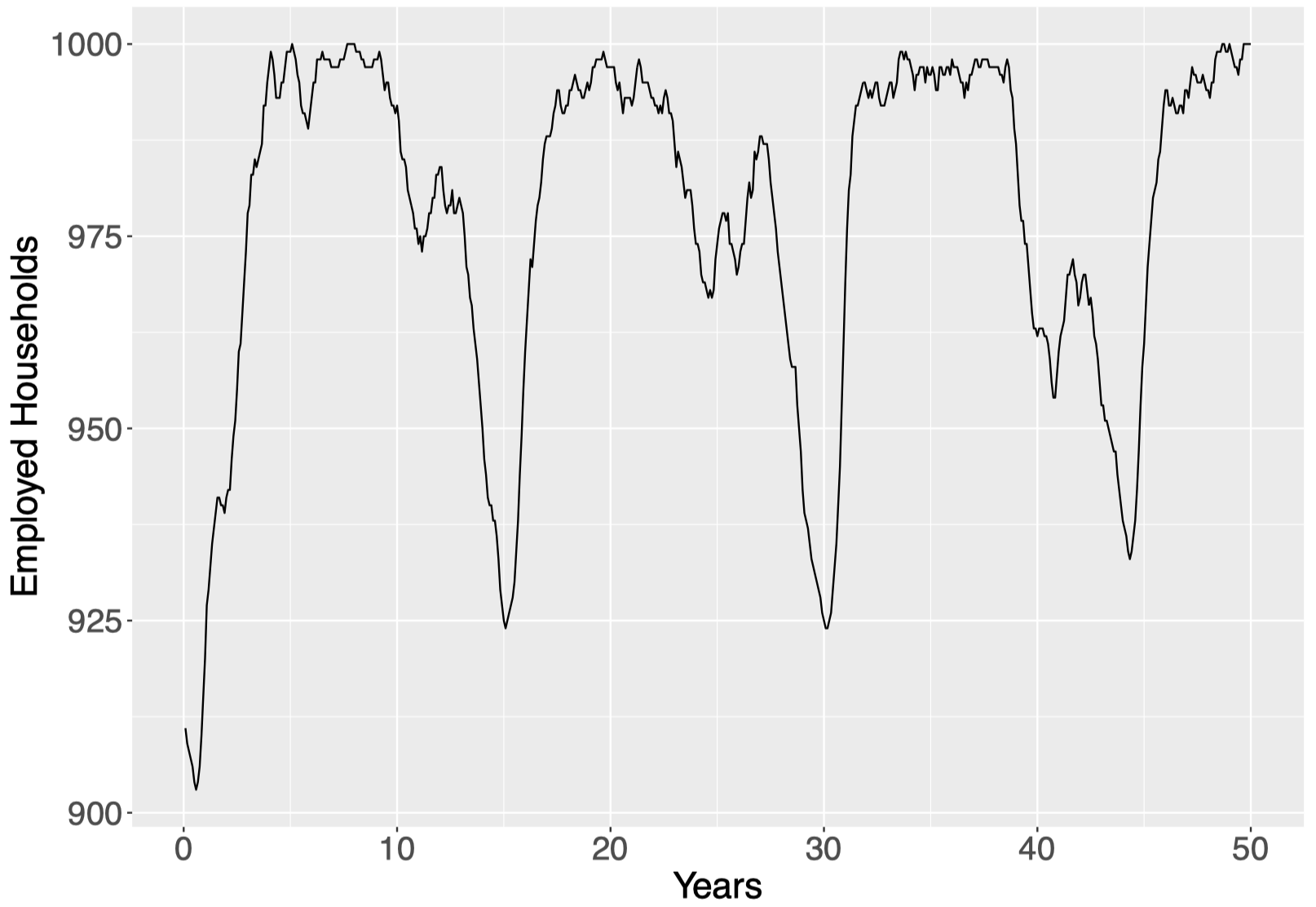

A macroeconomy simulated with two types of software agents: households that decide whom to buy from and work for, and firms that decide headcount, wages, and prices. This is a Lengnick model, which shows that even without exogenous shocks, recessions can just emerge from economic agents temporarily failing to coordinate with each other.

More

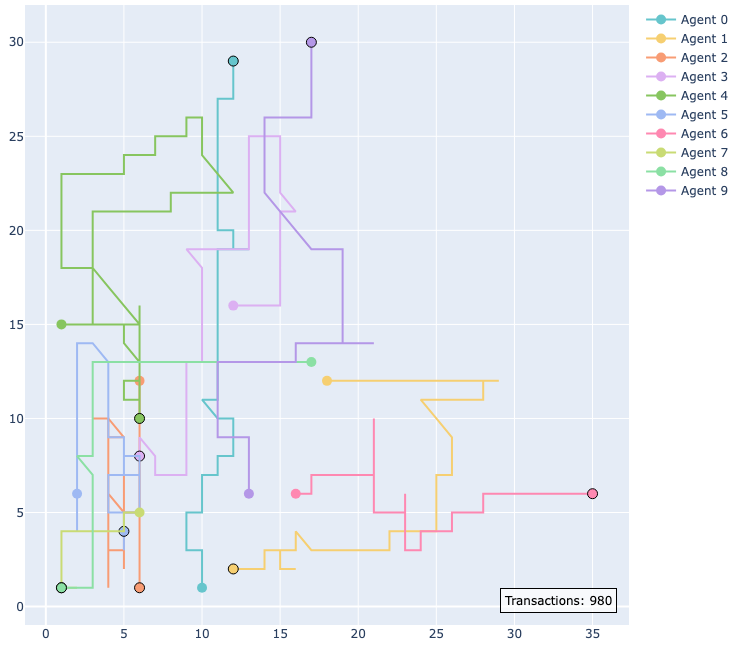

An agent-based model of a general bilateral exchange problem of any A agents and any N goods. This model uses boundedly rational agents, in the sense that the agents iteratively make trades without knowing the optimal quantities that maximize their utility. It can obtain a decentralized, numerical solution to a general equilibrium problem.

More

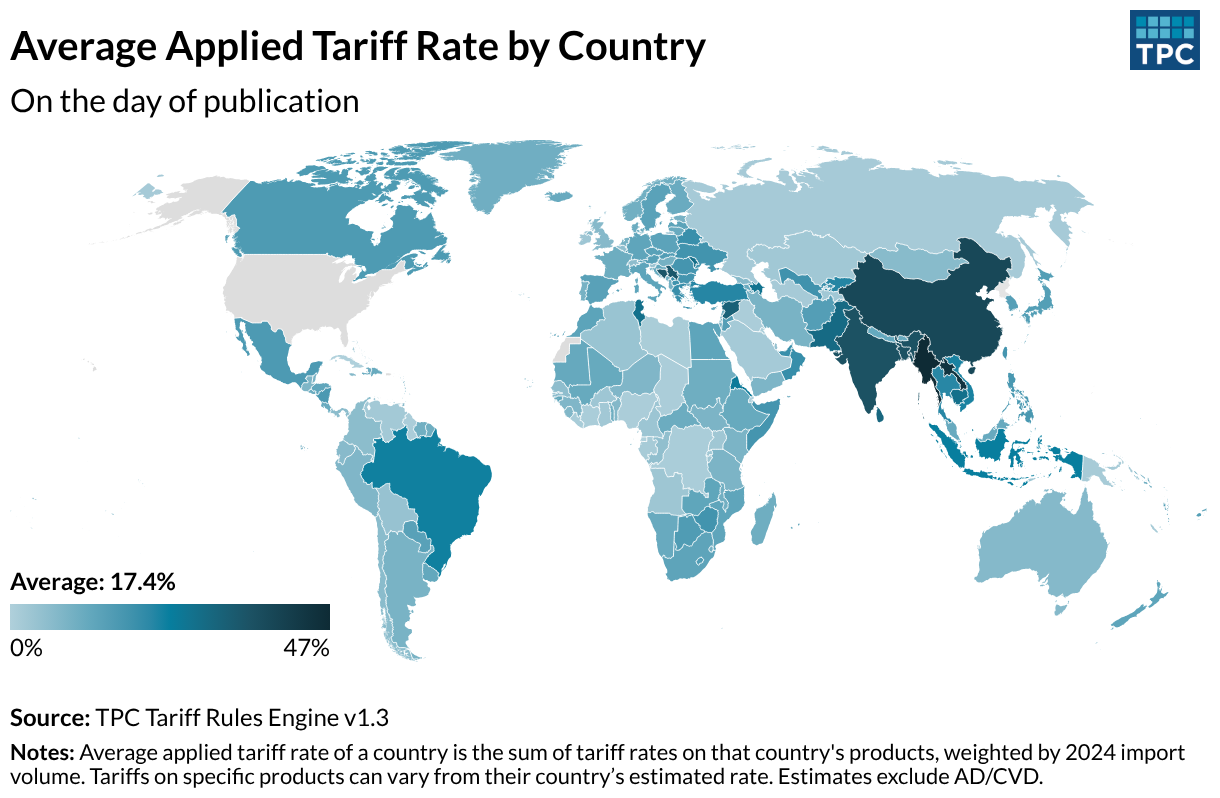

TPC's latest analysis on tariffs visualized.

More

I explain how TPC applies input-output analysis for tariffs.

MoreI introduce TPC's Tariff Rules Engine and its capabilities.

MoreUsing TPC's tariff supply chain model, Elena Patel, Robert McClelland, and I calculated that tariffs will add roughly $30 billion to the costs of investment in residential structures.

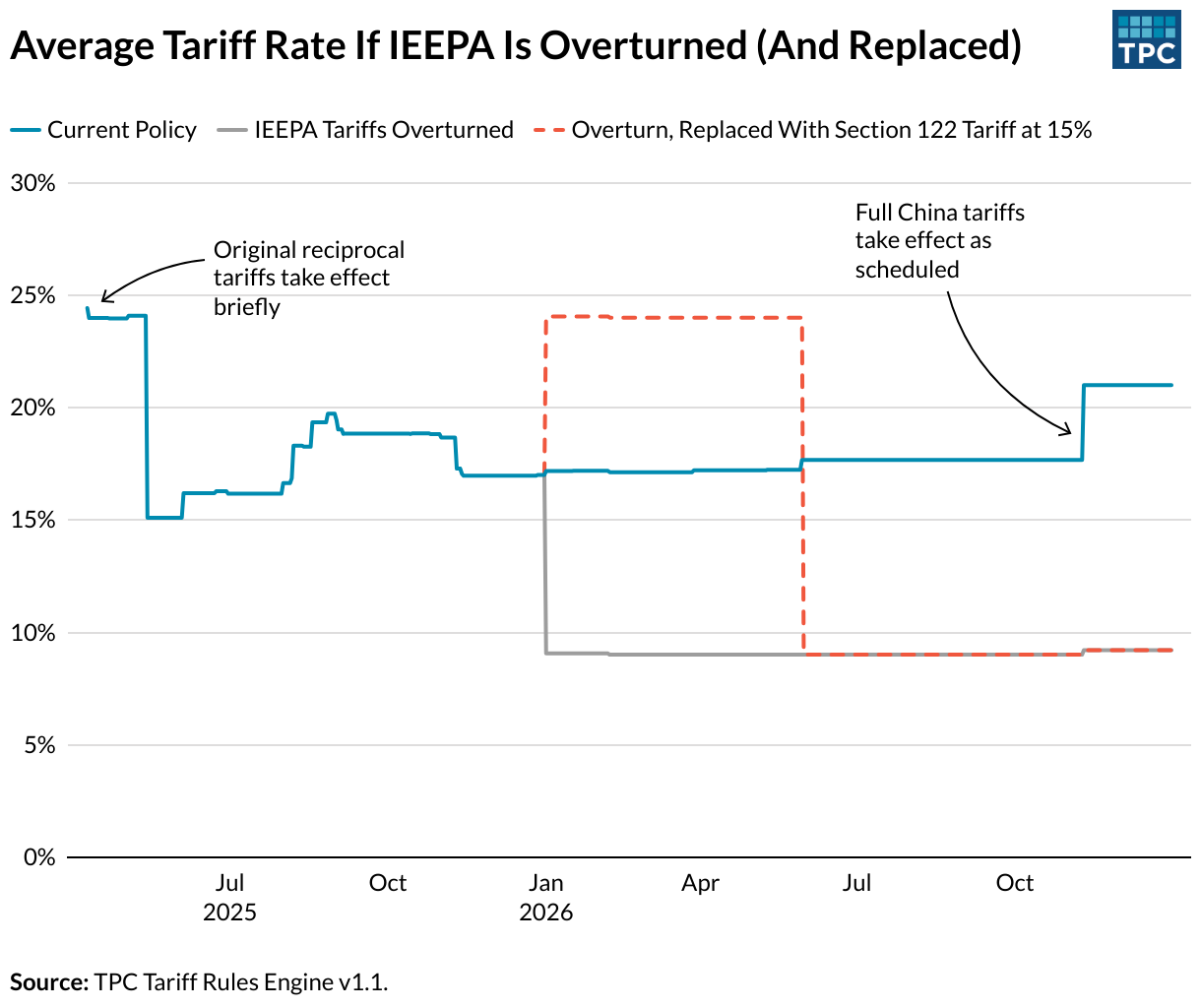

MoreWe use the tariff rules engine to analyze the marginal impact of IEEPA tariffs and simulate new tariffs.

More

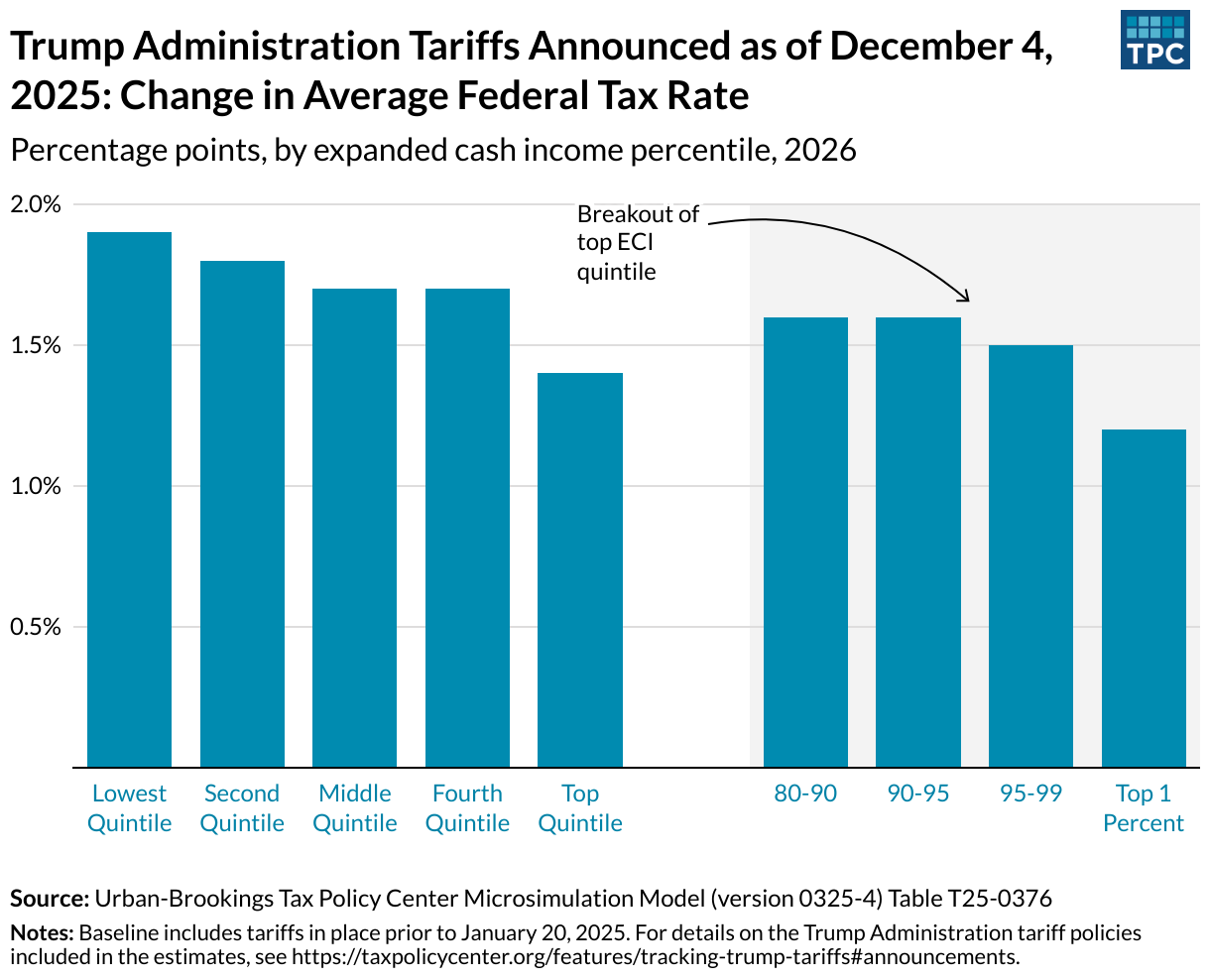

The distribution of tariff burden, generated with our latest tariff rules engine and input-output model.

More

Janet Holtzblatt, Rob McClelland, and I explore the difficulties of levying import duties on intellectual property.

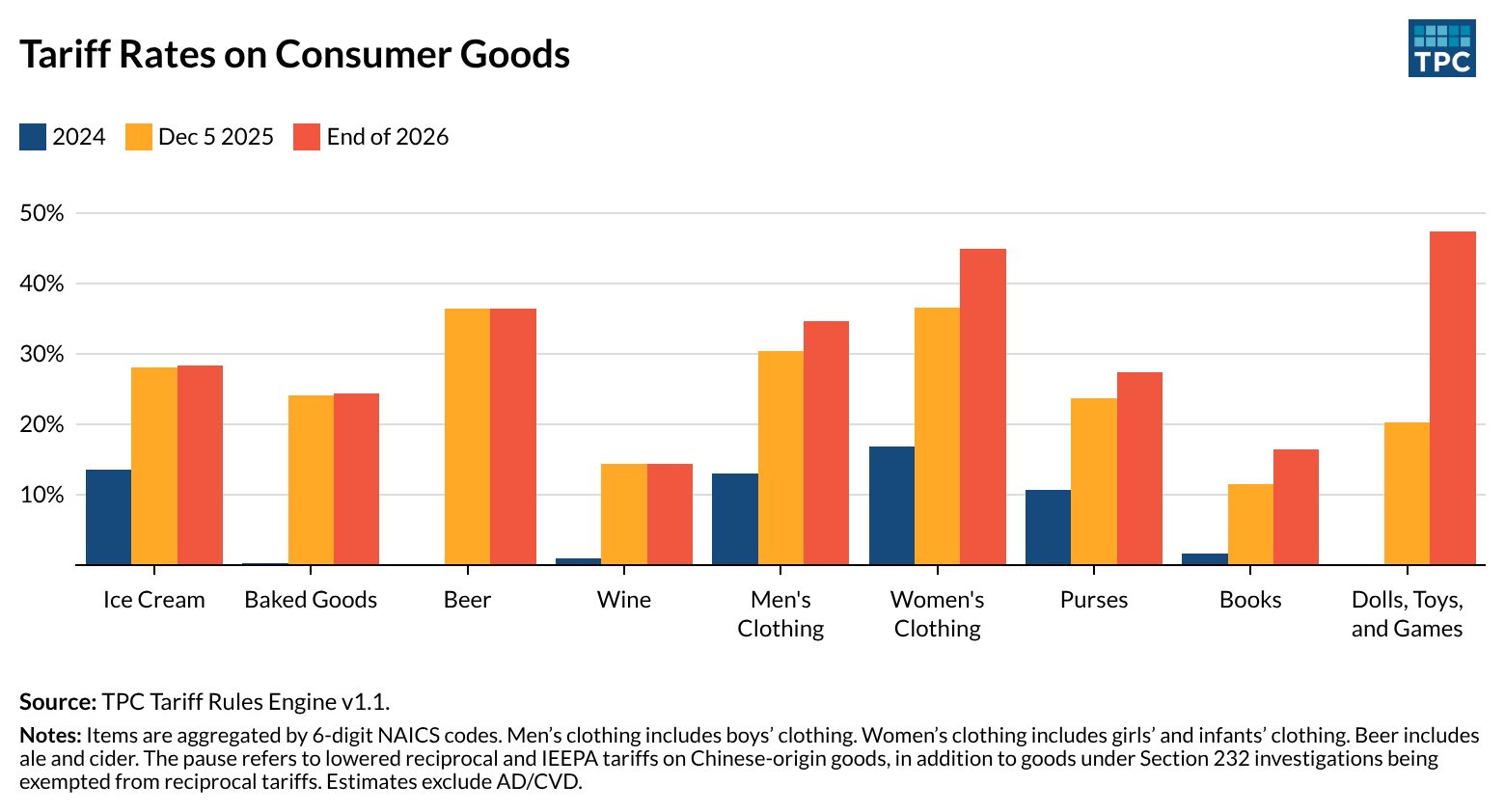

MoreTariffs are typically levied on countries. But consumers buy goods by category, not by country of origin. In my first piece for Urban-Brookings Tax Policy Center, Robert McClelland and I use our revamped tariff model to translate the effects of country-based tariffs on major consumer goods.

More

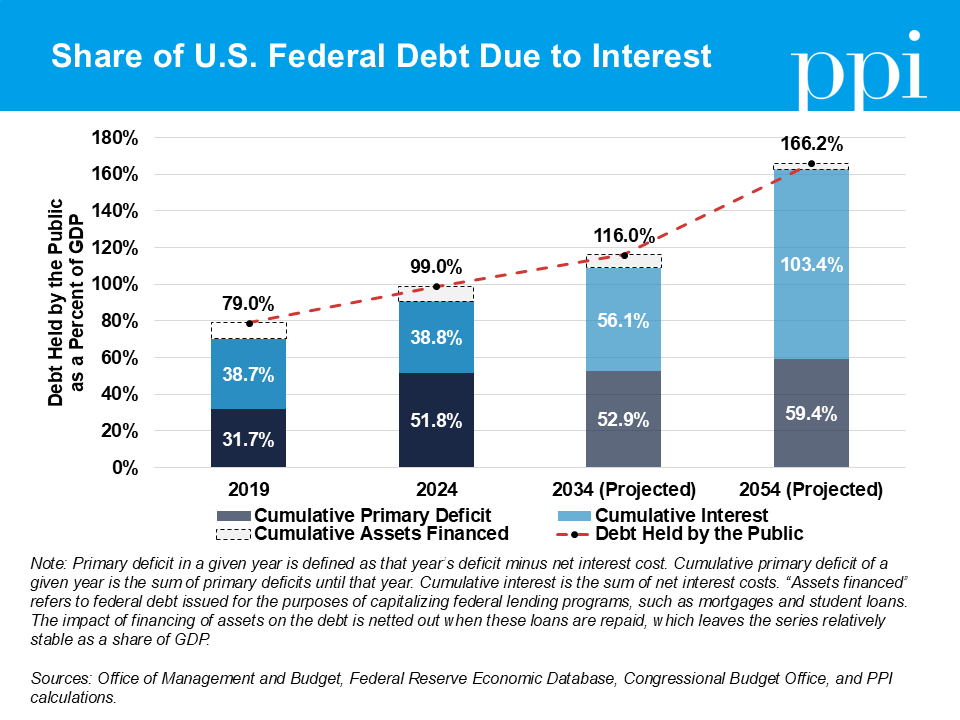

Nearly 40 percent of U.S. government debt today was issued just to cover interest on previous debt, and this problem is poised to worsen as recent borrowing accrues interest and Congress further cuts revenue.

More

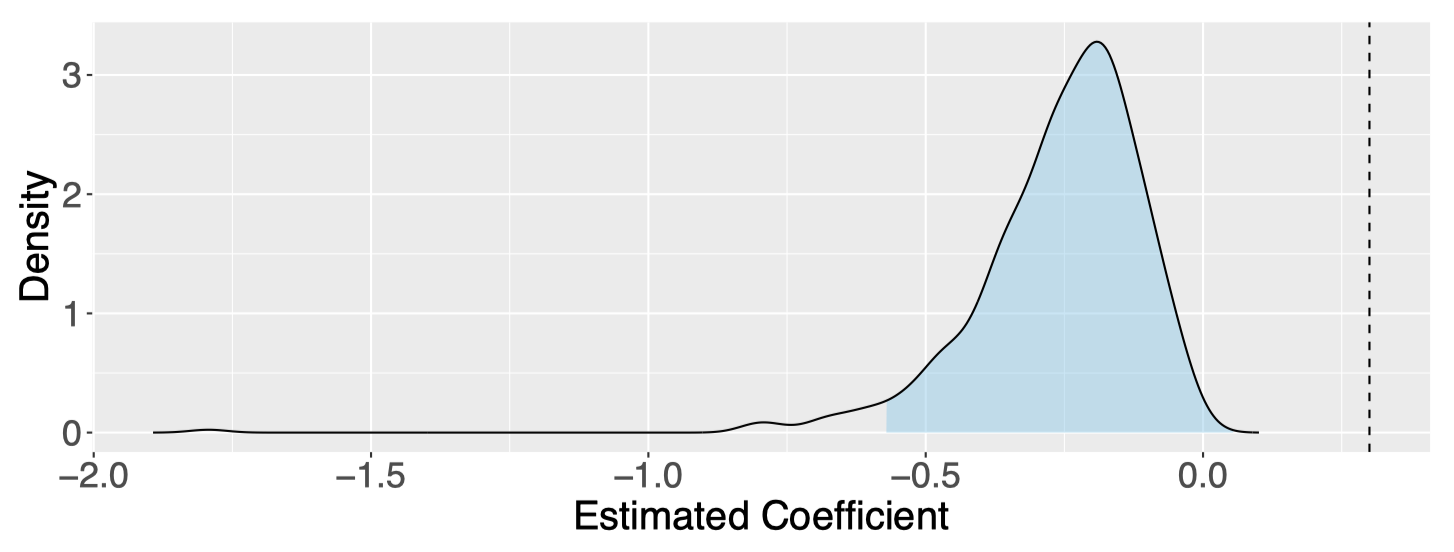

Many instrumental variable papers that identify treatment variations over long time periods are misspecified. I use difference equations, VAR representations, and Monte Carlo simulations to demonstrate this. I also propose a remedial two-stage-least-squares specification to correct for bias.

More

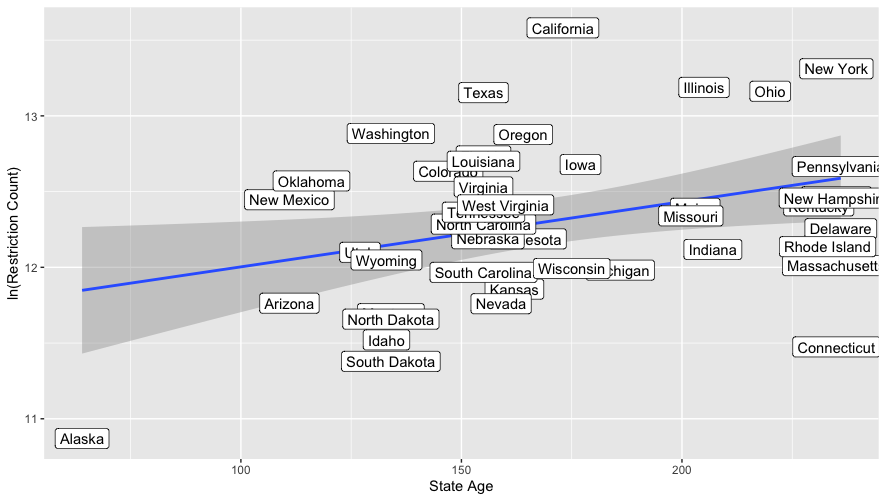

I wrote a paper with Patrick McLaughlin on using state age to estimate how increasing regulation causally affects growth. This project leverages the QuantGov project's State RegData.

More

A model of preference discovery with Alex Tabarrok.

To what extent does iMessage confer a monopolistic advantage to Apple? I estimate how much the service changes the demand elasticity for iPhones.